As residents of the island we do not pay federal income taxes, but we do pay the same federal medicare, social security, self-employment, unemployment, customs, and merchandise taxes as residents of the states. In 2022 the federal taxes paid by the residents of Puerto Rico to the US added up to $4.8 billion dollars. Nonetheless, residents of Puerto Rico do not get the same federal benefits. For example: Medicare and Medicaid have a spending cap, we are excluded from the SSI and federal EITC, and annually receive $1.6 billion less for nutritional assistance (through NAP instead of SNAP).

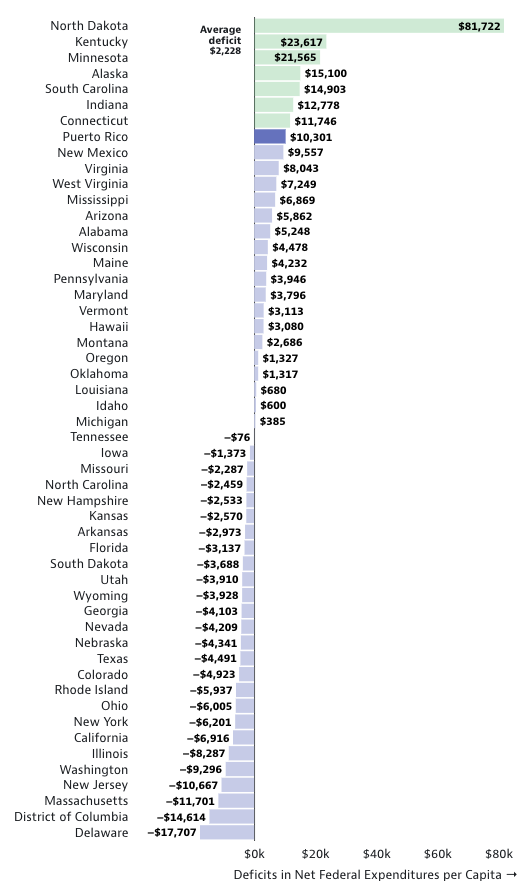

Puerto Rico does receive more federal expenditures than it pays in federal taxes, but so do half of the states!!!! Which include: Michigan, Idaho, Louisiana, Oklahoma, Oregon, Montana, Hawaii, Vermont, Maryland, Pennsylvania, Maine, Wisconsin, Alabama, Arizona, Mississippi, West Virginia, Virginia, New Mexico.

Moreover, seven states have a greater deficit in net federal expenditures per capita than Puerto Rico, these are: Connecticut, Indiana, South Carolina, Alaska, Minnesota, Kentucky and North Dakota.

Download here the one pager fact sheet.

See graphs below which reference data from IRS, USAspending.gov and Espacios Abiertos analysis: