Summary of the 2024-2025 budget as proposed by the Government and commented on by the FOMB. While the Board proposed the same amount of $13,062 million as the Executive’s version, it established a new distribution. The FOMB also reduced by almost $900 million the $13,954 million version approved by the Legislative Assembly that the Board invalidated once again relying on PROMESA. See the graphs below.

Espacios Abiertos’ team, under the direction of Daniel Santamaría-Ots, EA’s Research Director, produced this report and visualization. (You can Access the report in its English version here.)

With the purpose of democratizing access to fiscal information, Espacios Abiertos created the Fiscal Observatory, to foster better knowledge and understanding of the allocation of public funds through the visualization of the government’s budget (central government, municipalities, and debt service). Currently, the Fiscal Observatory allows you to access the proposed budget for the next fiscal year 2024-2025, as well as access the interactive dashboard with every budget approved, revenues and expenses since 2006. Over 50,000 fields of official data, easily available. Visit and explore our platform at https://www.observatoriofiscalpr.com

_______

While our elected bodies and the Financial Oversight and Management Board (FOMB) seem unable to agree on what constitutes the first balanced budget (see FOMB, letter to the Secretary of the Puerto Rico Department of Treasury) that could potentially lead to an exit in four years from the entity created by the U.S. Congress, the Board continues to determine each year both the amount and the composition of the budget for the people of Puerto Rico.

This fiscal year, beginning July 1, is no exception. In a first letter sent on May 16 to the executive branch (see FOMB, Notice of Violation to the proposed Commonwealth of Puerto Rico Budget for Fiscal Year 2024-2025), and pursuant to Section 202(c)(1)(B) of the PROMESA Act, the Board once again informs the people of Puerto Rico that the proposed (see OMB, Proposed Budget by the Governor for the Fiscal Year 2024-2025) General Fund budget does not reflect their public policy priorities. Although the Board proposed the same amount of $13,062 million as the executive version, it determined a new composition. In a second letter (see FOMB, Notice of Non-Compliance to the Legislative Assembly regarding the General Fund Budget for Fiscal Year 2024-2025) sent on June 23 to the Legislative Assembly, and pursuant to Section 202(d)(1) of the PROMESA Act, the Board this time invalidates the $13,954 million budget approved with a broad majority in both the House of Representatives and the Senate of Puerto Rico. Thus, we see once again that the Board not only decides the composition but also the size of the General Fund budget. This scenario worsens as the unilateral decision-making in budgetary matters has removed public budget debates and citizen participation (see EA, Two Budgets and Zero Participation) in public hearings. While letters and certifications are exchanged between the Board and the Puerto Rican government, the democratic deficit corners citizens’ right to decide.

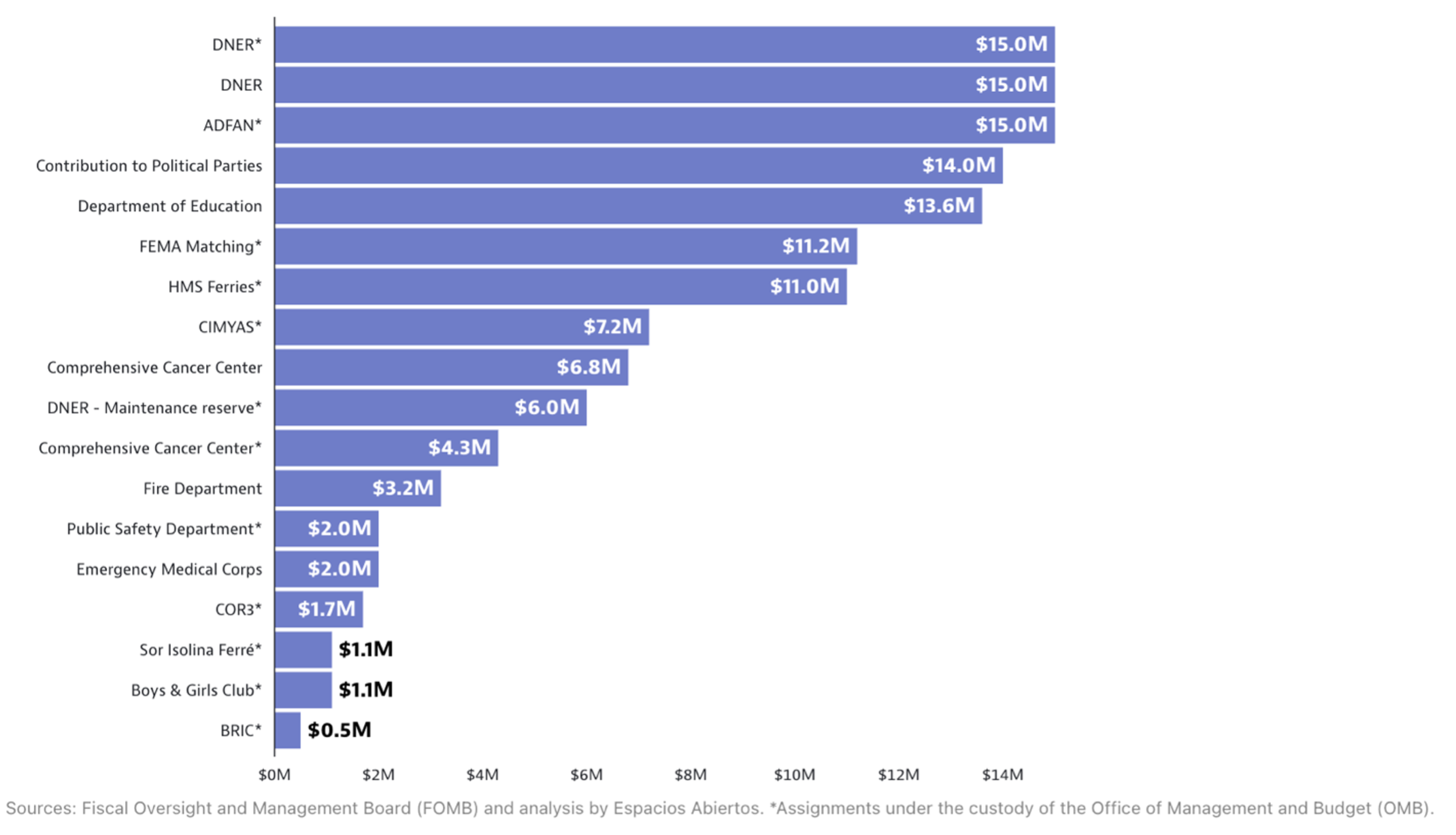

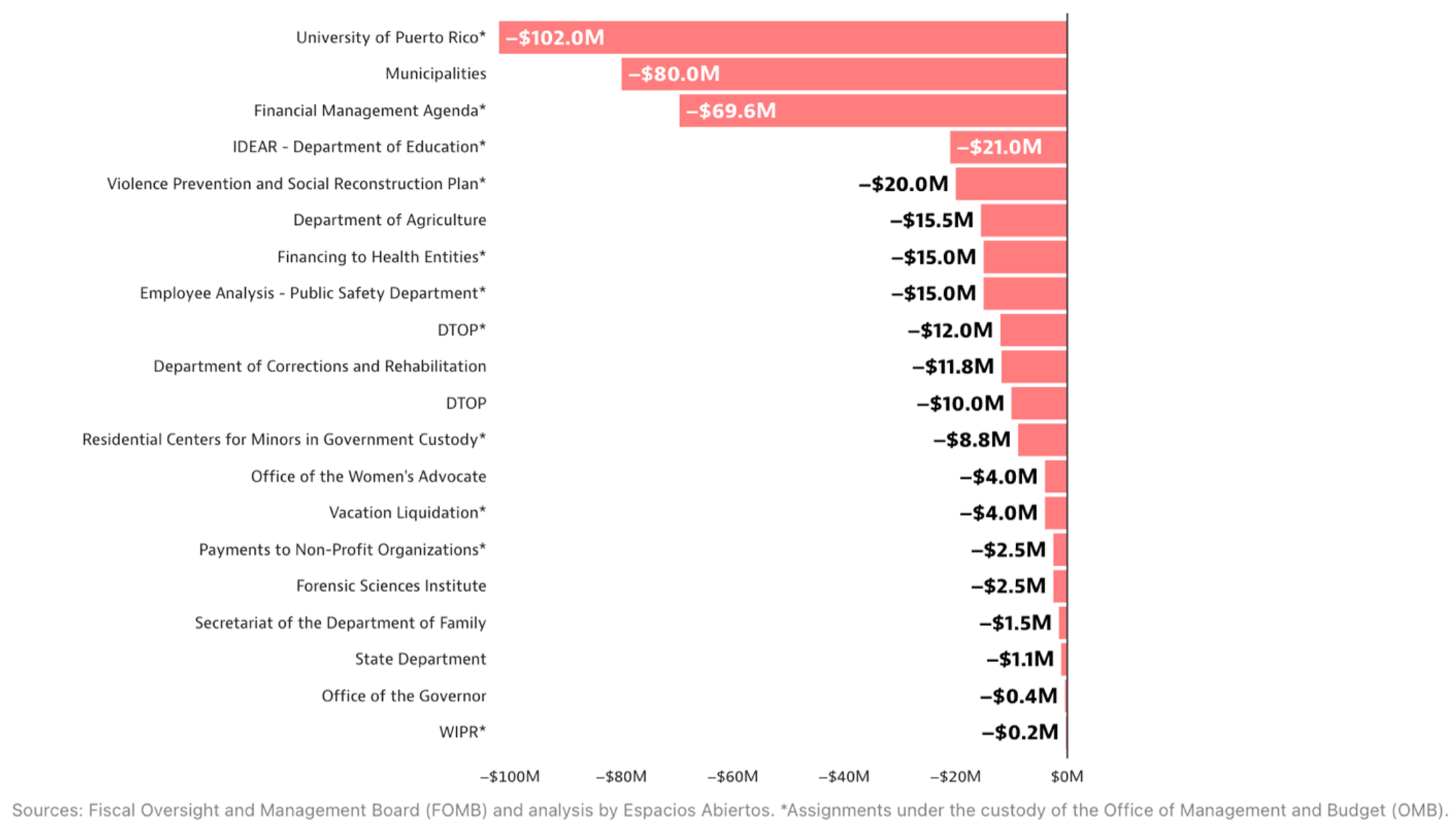

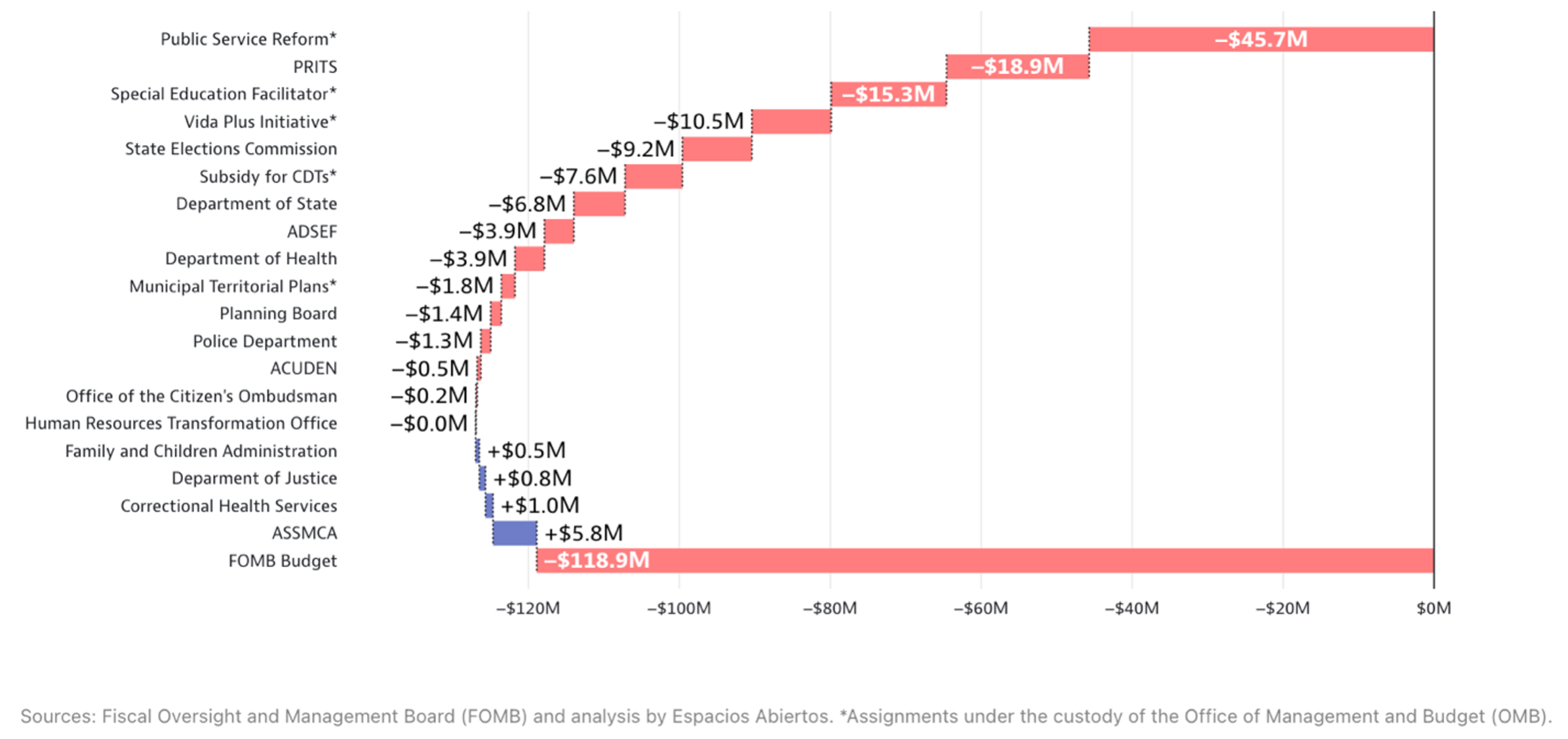

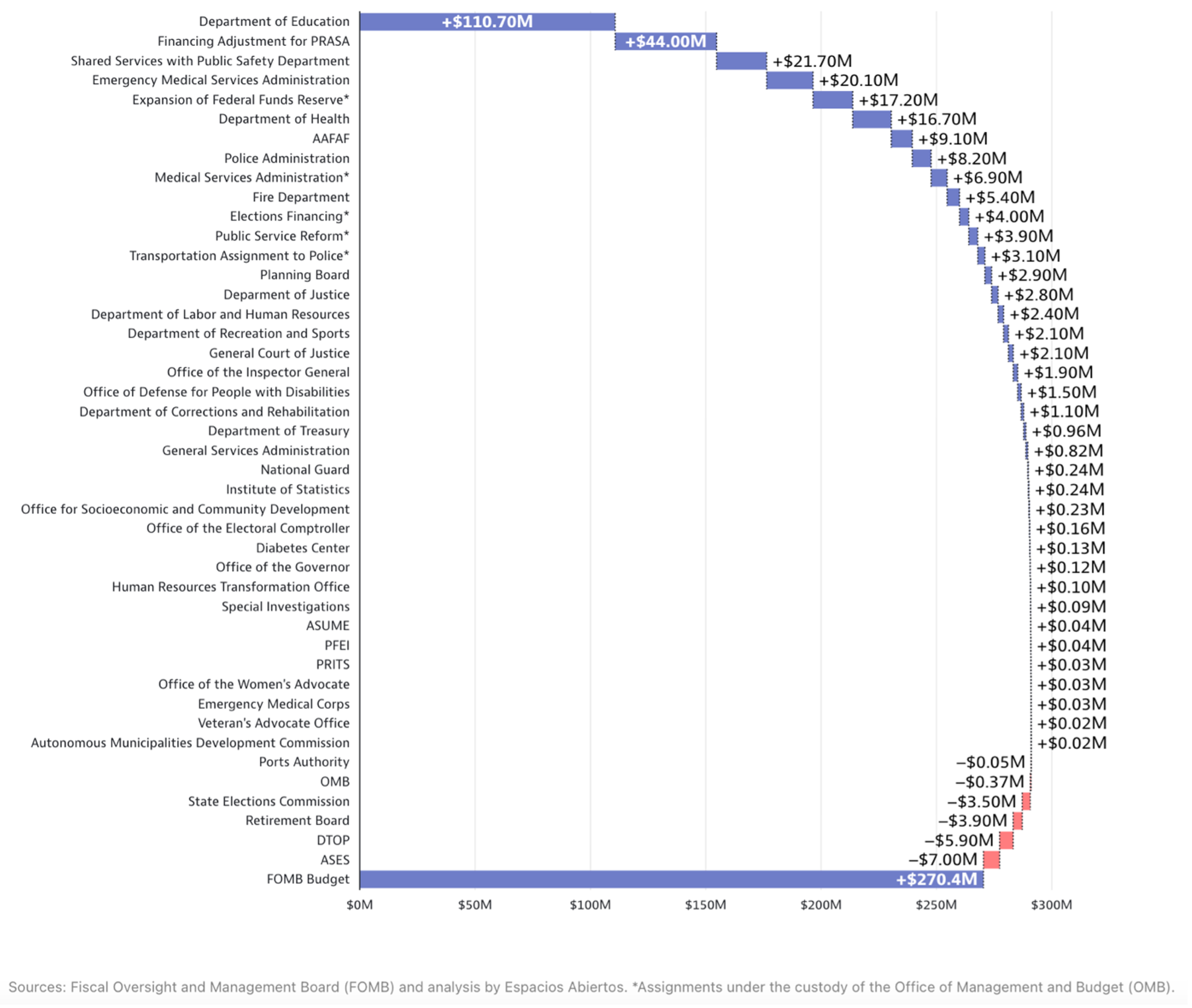

The Board has again determined that this year will approve certain measures, condition some, and deny others. Overall, this has resulted in the denial of $515.8 million and the approval of $401 million for the proposed General Fund budget for the next fiscal year. For example, while it conditions $102 million to the University of Puerto Rico (UPR) for the second consecutive year, it disallows $82 million to municipalities, denies $20 million to implement the social reconstruction and violence prevention plan, or declines $15.3 million to hire 856 special education coordinators, the Board does authorize $14 million to supplement funding for political party contributions.

Do these priorities represent your public policy and budget priorities?

Let’s analyze the Board’s message in response to the executive’s request for incremental funds and budget changes. The letter contains four major sections: 1) approved budget items that comply with the certified fiscal plan in force and with certain requested information requirements; 2) denied budget items that do not comply with the certified fiscal plan but could be reconsidered during the next fiscal year; 3) permanently denied items; and finally, 4) revised budget items with authorized budget increases and decreases. Access the Report here.