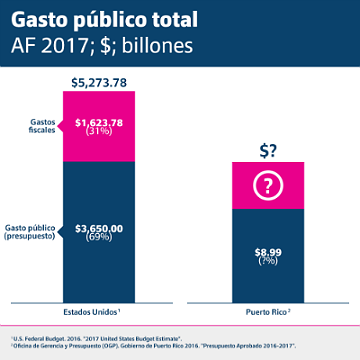

Since 2017, Espacios Abiertos has advocated for the publication of an official register or budget of fiscal expenses by the government of Puerto Rico, just as the federal government does since the 1970s, as well as all US states and most countries that are part of the Organization for Economic Cooperation and Development (OECD). We strongly recommend that the publication of the report should not be left to the discretion of the current governor, but rather to enact legislation as 49 states and DC have done requiring its preparation and publication to serve as an instrument in the annual process of discussion and approval of the budget.

In a government credibility crisis like the one Puerto Rico is currently experiencing, the creation and publication of the register of fiscal expenses is a tool that allows citizens to know what and how much money the government is spending. The collection and publication of tax expenditures facilitates compliance with the disclosure standards of “tax abatements” established by the “Governmental Accounting Standards Board” in the GASB 77 since 2015 for all governments and their instrumentalities when preparing their Audited Financial Reports.

In addition to ending speculation around the total amount of tax expenses in Puerto Rico, other questions that must be addressed by annually publishing and having a timely discussion about an official tax incentives registry (fiscal expenses budget) are:

- What is the level of transparency of the internal government analyses in terms of evaluating which fiscal expenses should be maintained or eliminated? What evaluation methodologies are being used?

- What is the process of scrutiny and cost-benefit analysis of tax expenditures?

- How do we know which tax expenditures offer a social benefit for the citizenry rather than only benefiting economic powers with greater lobbying power?

- What is the economic impact of reducing public spending due to the elimination of certain fiscal expenses?

- Which taxpayers are affected by the elimination of certain tax expenses: the most privileged or the most disadvantaged?